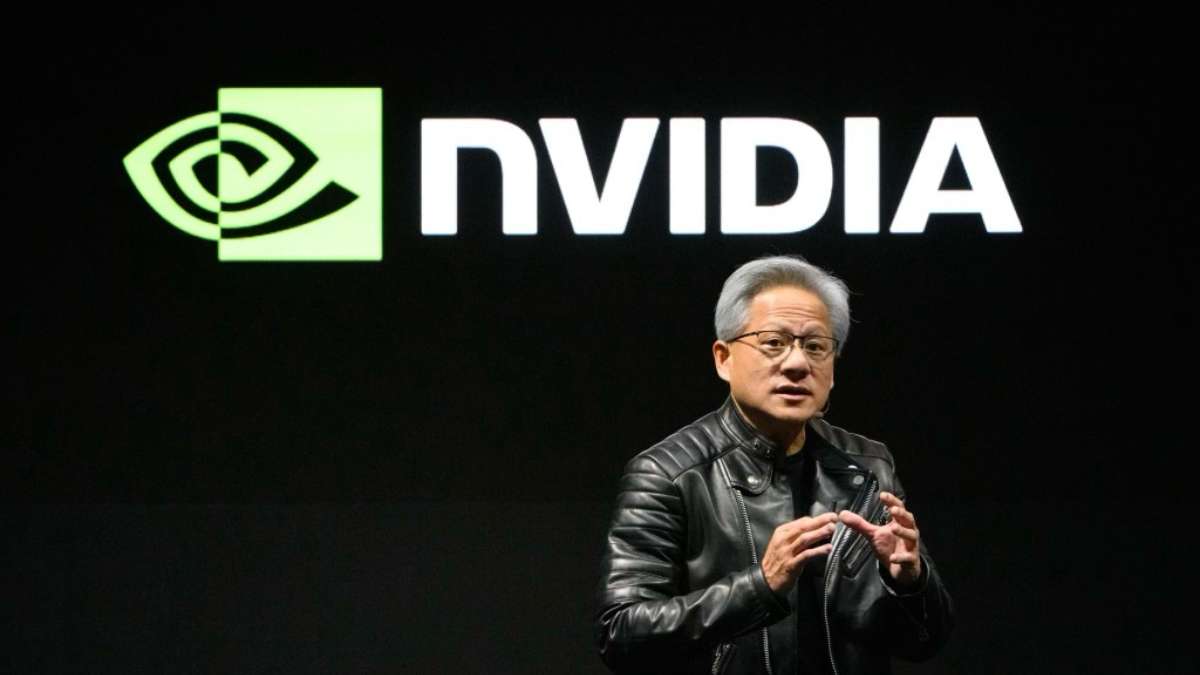

Nvidia Becomes the First Company to Surpass $4 Trillion Market Value

Nvidia made history on July 9, 2025, briefly becoming the first publicly traded company ever to exceed a $4 trillion market capitalization. This milestone marks a significant moment in the race for dominance in the fast-evolving AI industry

Nvidia has done something no other company has ever done before. On July 9, 2025, it became the first publicly traded company in the world to cross $4 trillion in market value, even if just for a short time. This is a huge moment in tech and stock market history.

Nvidia’s share price went up sharply on Wednesday morning, touching over $164 for a brief time. This pushed its total value (market capitalization) above the $4 trillion mark.

By the end of the day, the stock had come down slightly and closed at around $159, so the company ended the day just under the $4 trillion level. Still, it officially became the first company to reach this milestone, even if only during intraday trading.

Experts say the stock only needs to go up by about 3% more for the company to hold that position more firmly.

Why Is Nvidia Growing So Fast?

Nvidia makes high-performance chips that are used to power Artificial Intelligence (AI) systems, including chatbots, image tools, and cloud services. As AI has become more important, more companies like Google, Microsoft, Meta, and Amazon are buying Nvidia’s chips to build smarter AI tools.

Here are some reasons why Nvidia is doing so well:

- Strong demand for AI chips and graphics processors (GPUs)

- Used by almost every major tech company building AI tools

- Massive profits and steady growth over the last few years

- Its chips are hard to replace—very few companies can match their performance

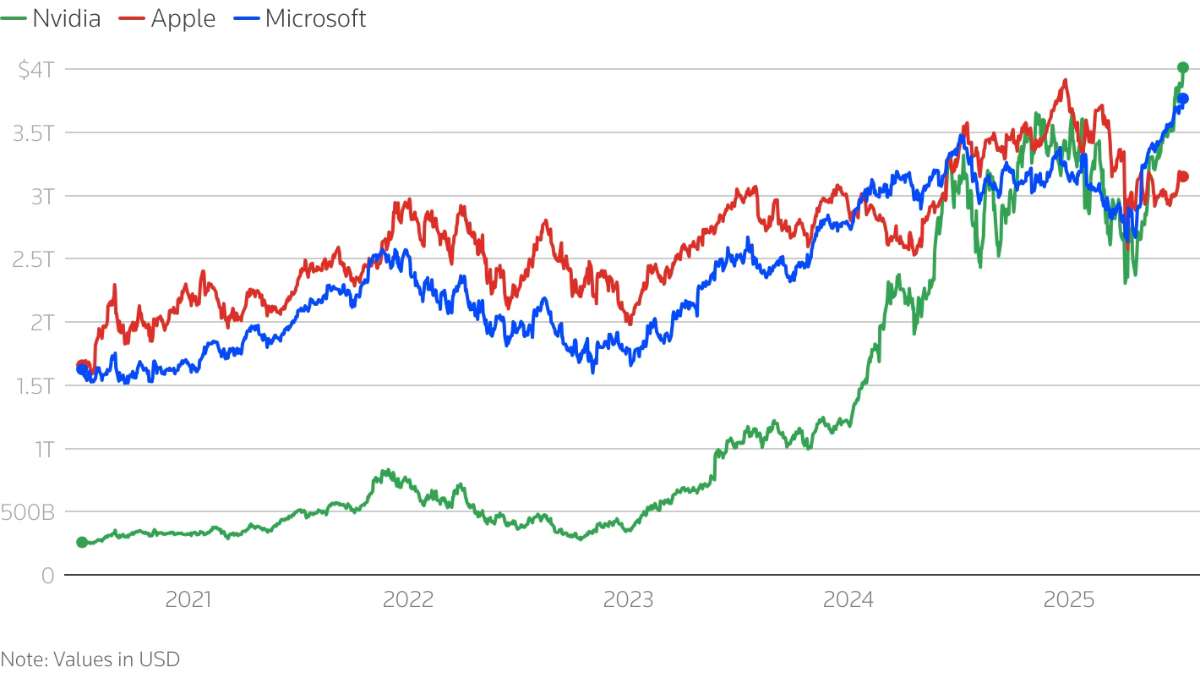

How Does It Compare to Other Big Companies?

To give you an idea of how big Nvidia has become, here’s how it compares:

|

Company |

Market Value (Approx.) |

|

Nvidia |

$4 Trillion (peak) |

|

Microsoft |

$3.7 Trillion |

|

Apple |

$3.2 Trillion |

Nvidia is now worth more than the entire UK stock market, and even Canada’s and Mexico’s markets combined.

What’s Pushing the Price Up?

- AI Boom: Everyone is talking about AI in 2025. Nvidia makes the chips that power this boom.

- Big Tech Clients: Microsoft, Meta, Amazon, and others rely on Nvidia chips for AI research.

- Investor Confidence: Investors believe Nvidia will continue to grow with the AI industry.

- Analyst Support: Banks and research firms have raised Nvidia’s price targets. Some now say the stock could go as high as $190 in the near future.

Even though Nvidia is doing great, there are still some things to watch out for:

- Export Restrictions: The U.S. government may limit sales of Nvidia chips to countries like China, which could impact profits.

- Overhype: Some investors worry the stock price is going up too fast and may come down if growth slows.

- AI Competition: Other chipmakers like AMD and Intel are also working on AI chips, which could lead to more competition.

Nvidia crossing $4 trillion is not just about money-it’s a sign of where the world is heading. AI is becoming part of everything we do, from smartphones to smart cars to business tools. And Nvidia is right at the canter of it all.

While the company still faces challenges, this achievement shows that the AI revolution is no longer in the future-it’s happening now.